south dakota excise tax on vehicles

Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. Alabama Georgia Hawaii New York Missouri and Wyoming all at 4.

Motor Fuels Taxes Diesel Technology Forum

Mobile Manufactured homes are subject to the 4 initial registration fee.

. South Dakota doesnt have income tax so thats why Im using sales tax. For an exact price select Interested in vehicle registration during signup and our specialist will contact you. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

2021 South Dakota Codified Laws Title 32 - Motor Vehicles Chapter 05B - Excise Tax On Motor Vehicles. Order stamps pay excise tax find retailer information and report. The rest are South Dakota and Oklahoma at 45 and North Carolina at 475.

Registrations are required within 45 days of the purchase date. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax. If I paid Excise tax on a new vehicle in South Dakota can I claim that as sales tax.

Dealers are required to collect the state sales tax and any applicable municipal sales tax municipal gross receipts tax and tourism tax on any vehicle product or service they sell that is subject to sales tax in South Dakota. Motor vehicle was on a licensed motor vehicle dealers inventory as of May 30 1985. Vehicle Identification Number VIN To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must.

Section 32-5B-1 - Imposition of tax--Rate--Failure to pay as misdemeanor. Motor vehicle excise tax. Find information on which cigarettes are allowed to be sold in South Dakota.

35th highest gas tax. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. On the other hand California has the highest sales tax at 725.

Dealers are not required to collect or pay the motor vehicle excise tax on motor vehicles they sell. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a south dakota titled vehicle according to exemption 36. 911 Emergency Surcharge Prepaid Wireless Tax.

Supports suppliers distributors and traders dealing with indirect excise taxes. Motor vehicle purchased prior to the June 1985 4 excise tax law or boat purchased prior to July 1 1993 excise tax law. South dakota excise tax on vehicles ile ilişkili işleri arayın ya da 20 milyondan fazla iş içeriğiyle dünyanın en büyük serbest çalışma pazarında işe alım.

The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B. Vehicles that have not been titled or registered in the US. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36.

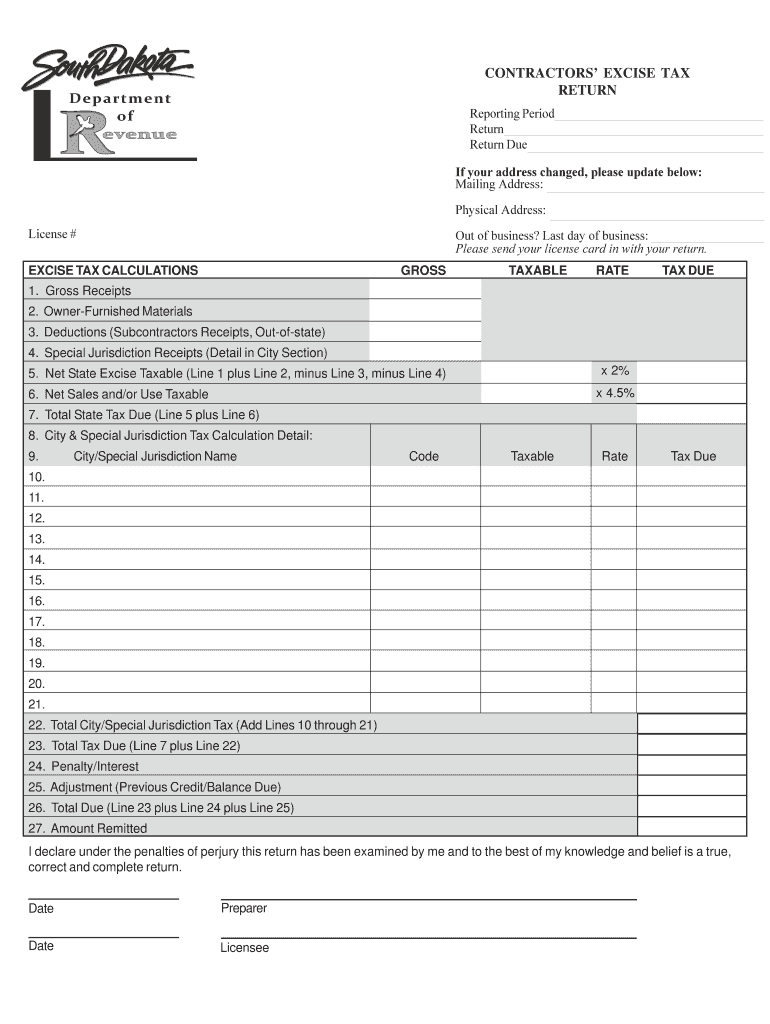

In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. A 2 contractors excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. One exception is the sale or purchase of a motor vehicle subject to the motor vehicle excise tax.

By the applicant will be subject to the 4 excise tax as of the date of this documentsubject to law changes If the purchase of the vehicle was within the last 6 months tax will be assessed on the purchase price shown on the provided bill of sale. You can find these fees further down on the page. Linscription et faire des offres sont gratuits.

Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32. ATVs purchased prior to July 1 2016 are exempt from the 4 excise tax. Motorcycles cars pickups and vans that will be rented for 28 days or less Trailers with a trailer ID plate under SDCL 32-5-81 that have an unladen weight of 9000 pounds or more and are rented for 6 months or less These are subject to the Motor Vehicle Gross.

While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation. Section 32-5B-11 - Licensing and payment of tax on leased vehicles--Assessment of tax upon purchase by lessee--Lessor to assign title and certify price fees and title. The South Dakota vehicle registration cost calculator is only an estimate and does not include any taxes fees from late registration and trade in fees.

Ad SD Contractors Excise Tax Return More Fillable Forms Register and Subscribe Now. Chercher les emplois correspondant à South dakota excise tax on vehicles ou embaucher sur le plus grand marché de freelance au monde avec plus de 21 millions demplois. No excise taxes are not deductible as sales tax.

In south dakota an atv must be titled. 84-Insurance company titles vehicleboat and does not pay 4 excise tax. All fees are assessed from purchase date regardless of when an applicant applies for title and registration.

However if purchased by an out of state business you will need to show proof of tax paid to your local Department of Revenue office. What is south dakotas sales tax rate. Get all the information you will need to title or renew your vehicle registration and license plates for your commercial vehicles.

The South Dakota excise tax on gasoline is 2200 per gallon lower then 70 of the other 50 states. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. House trailer subject to 4 initial registration fee upon initial registration.

They sell that is subject to sales tax in South Dakota. Plates are not removed from vehicle08 92-House trailer subject to 4 initial registration fee upon initial registration09 94-ATVs purchased prior to July 1 2016 are exempt from the 4 excise tax. This is followed by the quartet of Indiana Mississippi Rhode Island and Tennessee at 7.

Actual cost may vary. 1151 in South Dakota that is governed by. No excise taxes are not deductible as sales tax.

AND 2reside on Indian country as defined by 18 USC. Motor vehicle purchased prior to the June 1985 4 excise tax law or boat purchased prior to July 1 1993 excise tax law. South Dakotas excise tax on gasoline is ranked 35 out of the 50 states.

Sales Tax Exemptions in South Dakota. However some state excise tax is deductible as personal property tax on Schedule A itemized deductions in place of car registration fees. 1be an enrolled member of a federally recognized Indian tribe.

The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. 95-A title only is issued when the applicant does not purchase license plates or pay the 4 excise tax. Motor vehicles not subject to motor vehicle excise tax include.

The South Dakota gas tax is included in the pump price at all gas stations in South Dakota. This page discusses various sales tax exemptions in South Dakota.

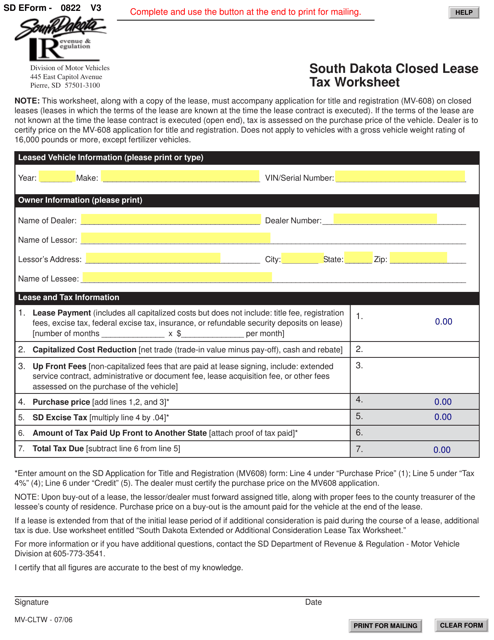

Sd Form 0822 Mv Cltw Download Fillable Pdf Or Fill Online South Dakota Closed Lease Tax Worksheet South Dakota Templateroller

1928 Chrysler Imperial Series 80 Chrysler Imperial Chrysler Imperial

Sales Tax On Cars And Vehicles In South Dakota

Individual Faqs South Dakota Department Of Revenue

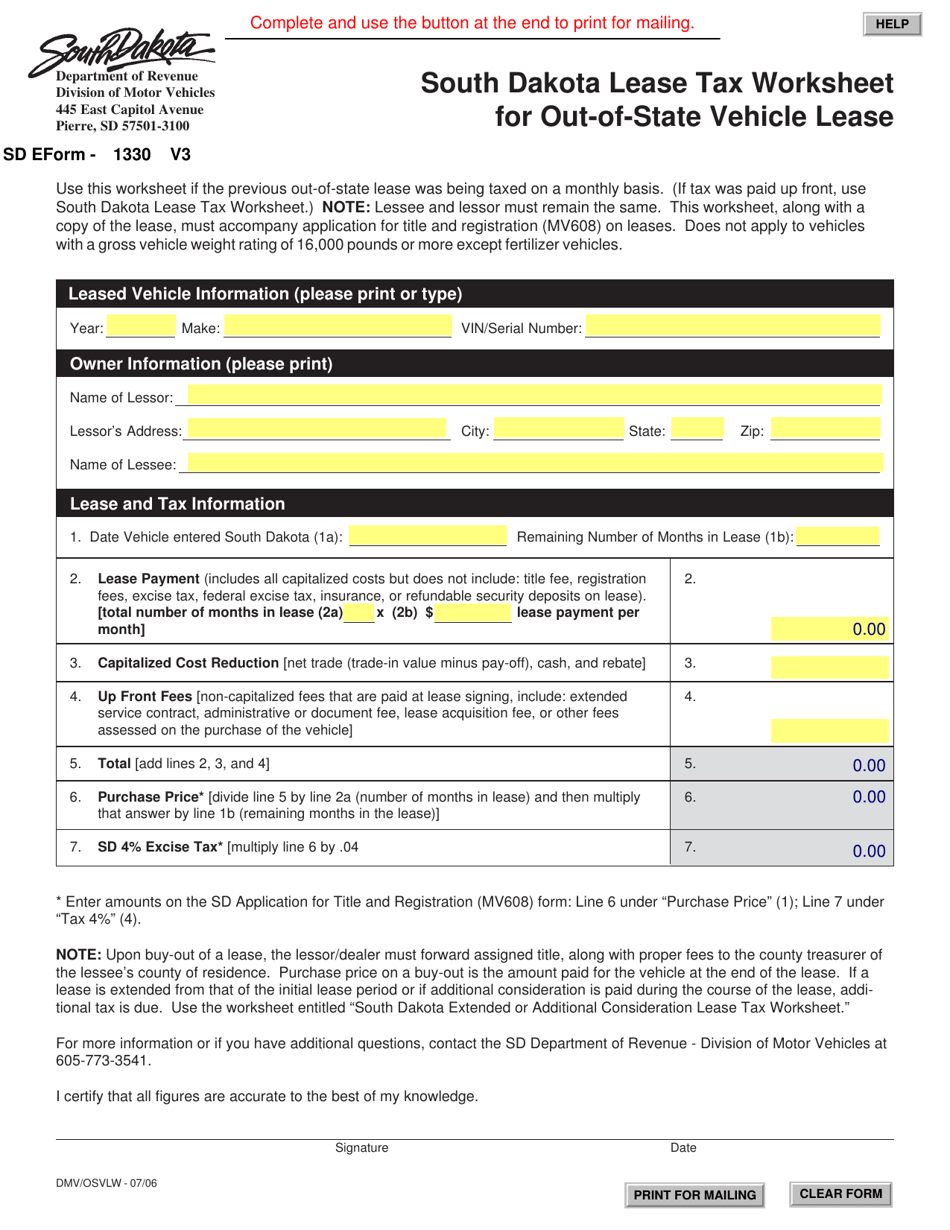

Sd Form 1330 Download Fillable Pdf Or Fill Online South Dakota Lease Tax Worksheet For Out Of State Vehicle Lease South Dakota Templateroller

Dealer Vehicle Licenses South Dakota Department Of Revenue

Business Faqs South Dakota Department Of Revenue

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Used Cars For Sale Under 10 000 Used Car Dealer Serving Fargo Thief River Falls And Devils Lake

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

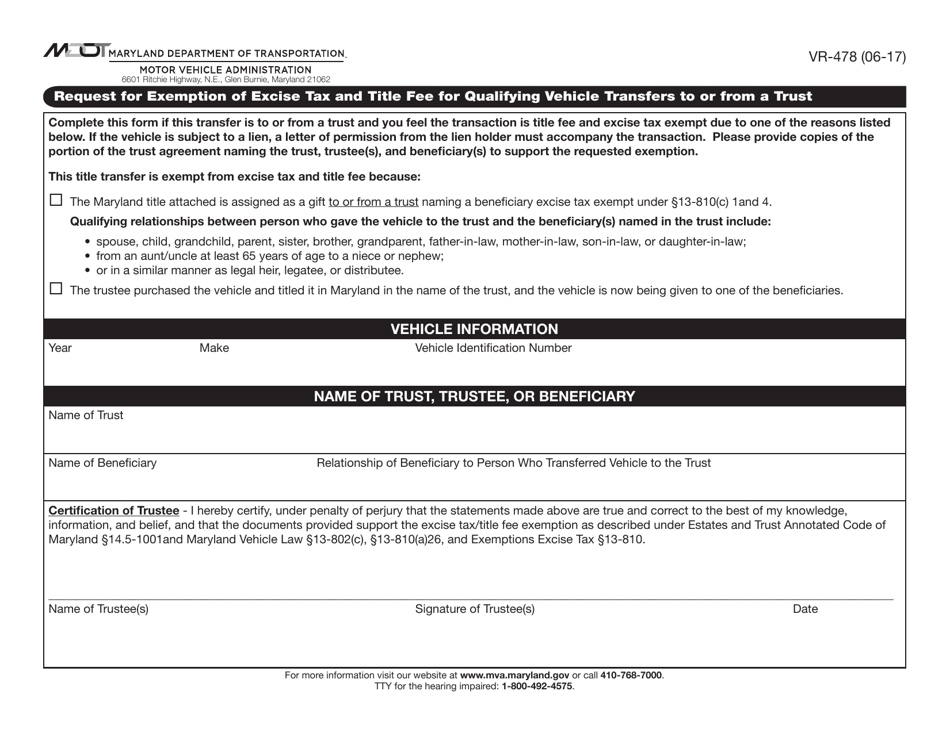

Form Vr 478 Download Fillable Pdf Or Fill Online Request For Exemption Of Excise Tax And Title Fee For Qualifying Vehicle Transfers To Or From A Trust Maryland Templateroller

What S The Car Sales Tax In Each State Find The Best Car Price