does texas have an inheritance tax 2019

No estate tax or inheritance tax Vermont. Someone will likely have to file some taxes on your behalf after your death though including the following.

What Is Inheritance Tax Iht Rates Exceptions Tower Street Finance

The sales tax is 625 at the state level and local taxes can be added on.

. 2 An estate tax is a tax on the value of the decedents property. New York raised its exemption level to 525 million this year and will match the federal exemption level by 2019. There is also no inheritance tax in Texas.

Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. Alaska is one of five states with no state sales tax. As of 2021 the six states that charge an inheritance tax.

Fourteen states and the District of Columbia impose an estate tax while six states have an inheritance tax. If you have a loved one who dies in Pennsylvania and leaves you money you may owe taxes to. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

The top inheritance tax rate in any state is 18. In addition to the federal estate tax of 40 percent some states impose an additional estate or inheritance tax. Inheritance tax rates differ by the state.

The tax rate varies depending on the relationship of the heir to the decedent. Has the highest exemption level at 568 million. Prior to september 15 2015 the tax was tied to the federal state death tax credit.

An inheritance tax is a tax on the property you receive from the decedent. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Non-relatives pay 18 on amounts over 10000.

Does Texas Recognize. Higher rates are found in locations that lack a property tax. Note that if you leave everything to your spouse there is no estate.

Its paid by the estate and not the heirs although it could reduce the value of their inheritance. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. All six states exempt spouses and some fully or partially exempt immediate relatives.

Final individual federal and state income tax returns. Its inheritance tax was repealed in 2015. However localities can levy sales taxes which can reach 75.

There are no inheritance or estate taxes in Texas. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. The state of Texas is not one of these states.

Near the end of the interview procedure TurboTax stated. The state of Texas does not have an inheritance tax. These states have an inheritance tax.

For example in Pennsylvania there is a tax that applies to out-of-state inheritors. The state repealed the inheritance tax beginning on September 1 2015. You are required to file a state business income tax return in.

Maryland imposes the lowest top rate at 10 percent. However this is only levied against estates worth more than 117 million. In fact texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. This means that if you have 3000000 when you die you will get taxed on the 300000 over the 2700000 exemption.

However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. More distant relatives pay 13 for amounts over 15000 and.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. There is a 40 percent federal tax however on. Final federal and state income tax returns.

The rates of tax in Minnesota on amounts over 2700000 are between 13 16. Texas also imposes a cigarette tax a gas tax and a hotel tax. His assets were held in a living trust that became an irrevocable trust upon his death.

Surviving spouses are always exempt. Texas does not have a state estate tax or inheritance tax. The state of Texas does not have any inheritance of estate taxes.

State inheritance tax rates range from 1 up to 16. No estate tax or inheritance tax Utah. The top estate tax rate is 16 percent exemption threshold.

Federal estatetrust income tax. These states have an inheritance tax. That said you will likely have to file some taxes on behalf of the deceased including.

As of 2021 the six states that charge an inheritance tax are. So only very large estates would ever need to worry about this tax becoming an issue. The state business return is not available in TurboTax.

The state repealed the inheritance tax beginning on 9115. Texas has no income tax and it doesnt tax estates either. As of 2019 only twelve states collect an inheritance tax.

Theres no personal property tax except on property used for business purposes. Each are due by the tax day of the year following the individuals death. The federal government of the United States does have an estate tax.

Minnesota has an estate tax for any assets owned over 2700000 in 2019. There is a 40 percent federal tax however on estates over 534 million in value. Massachusetts has the lowest exemption level at 1 million and DC.

Up to 25 cash back parents siblings and other close relatives can inherit 40000 tax-free and pay just 1 of the market value of inherited property over that amount. The 1041 federal return was for the estate of my father who died in the middle of 2018. Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if.

Does Texas Recognize Domestic Partnership In 2019.

States With Highest And Lowest Sales Tax Rates

Talking Taxes Estate Tax Texas Agriculture Law

Annuity Beneficiaries Inheriting An Annuity After Death

Foreign Inheritance Taxes What Do You Need To Declare Greenback Expat Tax Services

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

Pdf Inheritance Tax Regimes A Comparison

United Kingdom Tax Treaty International Tax Treaties Compliance

How To Avoid Estate Taxes With A Trust

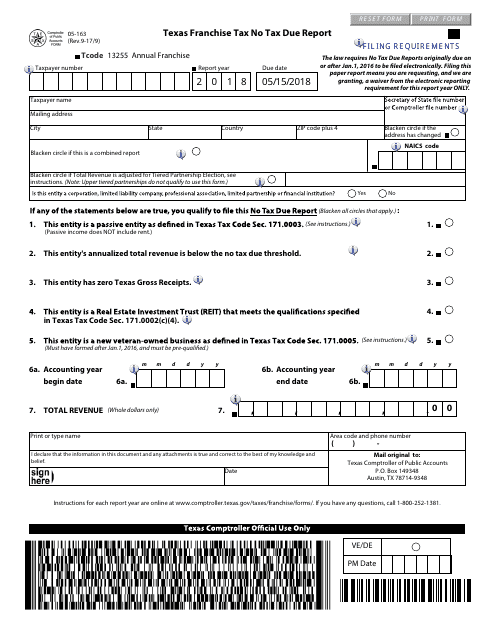

Form 05 163 Download Fillable Pdf Or Fill Online Texas Franchise Tax No Tax Due Report 2018 Texas Templateroller

Opinion Rich Kids Can Spare Some Of Their Inheritance The New York Times

Recent Changes To Estate Tax Law What S New For 2019

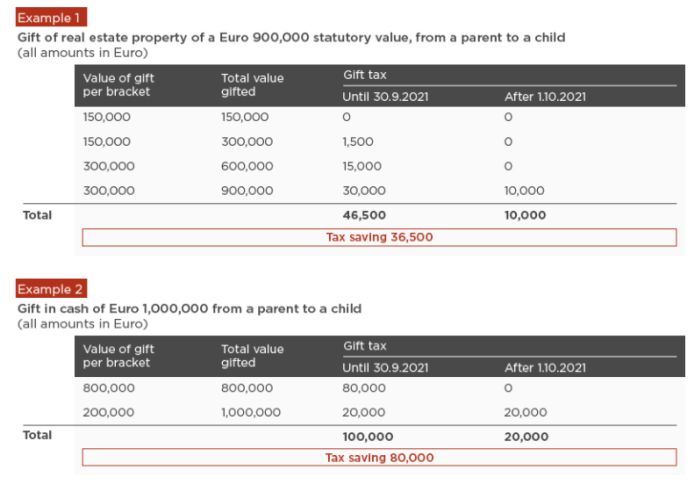

Greece Increases Gift Tax Exempt Bracket From October 1 2021 Inheritance Tax Greece

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

How Is Tax Liability Calculated Common Tax Questions Answered

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

Texas Rental Property Taxes Rental Property Tax Benefits

How Do Taxes Affect Income Inequality Tax Policy Center

Will Inheritance Tax Be Due On My Family Member S Estate Ellisons Solicitors